Income tax is levied on taxable income. Taxable income is calculated as [assessable income] less [any allowable deductions]. Deductions include wages, cost of stock, rent, bad debts, and previous year losses.

Sole traders are not required to complete a separate return for their business. They use their personal income tax return to report their business income and deductions. Partnerships complete a partnership tax return to show the partnership's income and deductions and how the profit or loss was shared among partners. Companies complete a company tax return to calculate the income tax the company should pay. Income tax is calculated according to taxable income for sole traders.

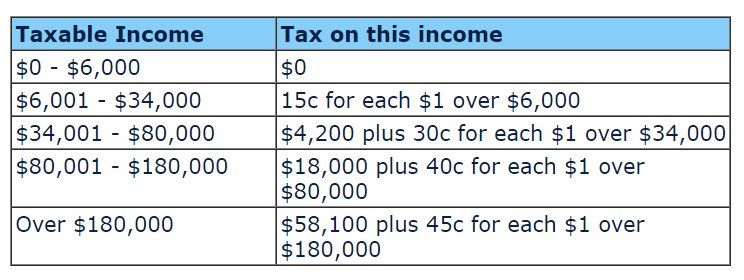

Resident Tax Rates 2008-09

NOTE: Resident tax rates do not include the Medicare levy of 1.5%.

FURTHER INFORMATION: Refer to the Medicare levy section of the ATO website for more information .

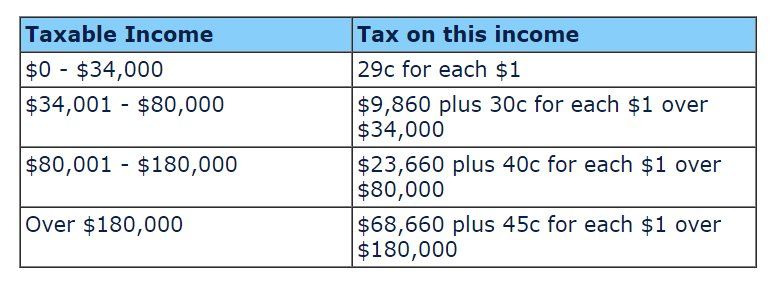

Non-Resident Tax Rates 2008-09

NOTE: Nonresidents are not required to pay the Medicare levy.

MORE: For more information on sole trader income tax, refer to the TaxPack section of the ATO website.

Partnership

A partnership running a business must complete a partnership tax return to show all income earned and deductions claimed for expenses during the course of the business. Each partner pays tax on their share of the partnership's income. Consequently they must include their individual share of the net partnership profit or loss in their personal tax return. Partnership and trust 2008 tax returns instructions are available on the ATO website.

Company

A company is a distinct legal entity with its own income tax liability therefore a company tax return must be completed for each company. A company's income tax is calculated as a percentage of the taxable income the company earned during the financial year. The company tax rate is 30%.

FURTHER INFORMATION: Company 2008 tax return instructions are available on the ATO website