If you have been reading the press lately you would have seen some bold predictions about future property values on the back of relatively low interest rates, a shortage of affordable housing and rental increases. Despite the threat of higher borrowing costs, groups like QBE LMI predict property prices in Melbourne will grow by 19% over the next three years.

Property research company, BIS Shrapnel, tell us that house prices have risen by an average of 9.4% a year since 1966 when a house could be bought for just $9,350! The median Melbourne house price is now more than $480,000 and BIS Shrapnel forecast this will rise to a staggering $1,056,199 in 2021. Given these facts could it be time to buy an investment property and what are the tax implications?

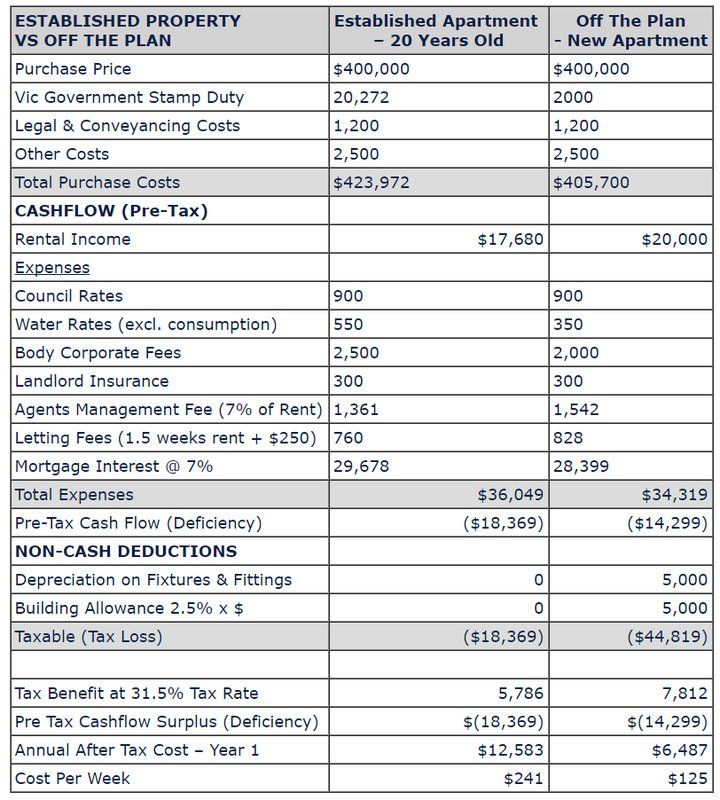

Clearly, buying an investment property is a significant financial commitment that should be thoroughly researched, carefully planned and most importantly, it must be financially sound. As your accountants, we see our role as helping you understand the tax and cashflow implications of this popular strategy. Many clients think they can’t afford to buy an investment property (or an additional one) so let’s compare the cost of owning a 20 year old flat or unit (costing $400,000) against purchasing an inner city ‘off the plan’ apartment for the same price.

This comparison is purely for illustrative purposes and should not be interpreted as a recommendation to buy any particular type of property. We have made a number of assumptions in producing this table including:

- The cost of both properties in Victoria is $400,000

- You borrow the full purchase price including stamp duty, conveyancing and legal costs

- The interest only loan is at the rate of 7%

- Rental income from the ‘off the plan’ property will be slightly higher ($385 vs $340)

- Depreciation on furniture and fittings in year one for the ‘off the plan’ property will be $5,000 while the depreciation deduction would be negligible for the established property because of the age and value of the fittings

- Construction costs for the off the plan property are $220,000 giving an annual building allowance claim of $5,500

- Your marginal tax rate is 31.5% (taxable income between $35,001 and $80,000 at 2009/10 rates)

Given these facts we have prepared a comparative ‘profit and loss’ report and note the following points of difference:

- Stamp Duty Savings apply because buying ‘off the plan’ means you only pay stamp duty on what is ‘established’ at the time of purchase. In the example below you will save $18,272.

- These stamp duty savings mean you borrow $18,272 less to fund the ‘off the plan’ apartment. As a consequence, your annual interest expense is $1279 less than buying the established property

- Depreciation (wear and tear) on fixtures and fittings in the ‘off the plan’ property would be substantial and it is a ‘noncash’ expense that does not involve the payment of any funds

- Building Allowance is another ‘noncash’ expense that lets you write off the construction costs of the building. Generally speaking, a residential investment property built after 18th July, 1985 can be depreciated at 2.5% per annum.

The financial analysis of the two properties indicates some significant differences. The after tax cost of owning the ‘off the plan’ apartment in year one is forecast to be only $6487 or $125 per week. The established property is forecast to cost you $12,583 or $241 per week.

This case study was designed to highlight the affordability of a negatively geared property and the impact of the ‘non cash’ deductions for depreciation and building allowance. In no way does it imply that an ’off the plan’ property is a better investment than an established property. We stress the importance of the property's capital growth to the overall wealth creation strategy. If you are thinking of buying an investment property we urge you to consult with our office before you commit to the purchase.